Modern Healthcare Technology Blog

The Return to In-Person Audits: Ensure Success and Compliance

McKaylin Felton, ACI 340B Account Management

During the COVID-19 pandemic, the 340B program witnessed a significant shift in auditing practices. Virtual replaced in-person to help ensure continuity and safety. However, in the past year, the in-person audit has begun to make its return. What does this mean for you as a covered entity? We’ll explore the impact of this transition, potential challenges to be aware of, and tips and tricks to maintain compliance and ensure a smooth audit.

MAINTAINING COMPLIANCE

The 340B program is full of complexities – which is why it’s essential to fortify your compliance strategy to ensure a smooth audit.

There’s been a recent trend by public health emergency auditors returning to inperson facility visits, although some audits are still being conducted virtually on a case-by-case basis. Although audits are often associated with dread and anxiety, there are a few key steps you can take to ensure preparedness:

1. Perform mock HRSA audits: Check for documentation, look at all your contracts and confirm you're not missing any amendments, or any PSAs associated to your contract pharmacies.

2. Save proof of internal and external audits.

3. Crosswalks: Work to build as much of the Data Request elements as possible. That way, if you do receive an audit notice, it’s as simple as reviewing and/or updating that information depending on how recently it was reviewed.

4. Review the 2023 Data Request List annually: Since 2012, HRSA has audited over 1400 covered entities. Each year, that number continues to increase, and is expected to follow trend in 2023. That’s why it’s important to use an updated Data Request List to analyze your program for any week spots.

TIPS AND TRICKS FOR A SMOOTH AUDIT

When you receive the sample claims from the HRSA auditor, it’s recommended to review each individual sample closely. From there:

• Save a copy of all universes (claims files) with Personal Health Information (PHI) included. HRSA requires all PHI to be removed for any submitted files. If you don’t save a copy with PHI included, there will be nothing to reference in the Electronic Medical Record (EMR).

• Print hard copies for each sample with the redacted PHI and number them. This can also be useful to give directly to an auditor. The auditor can use those hard copies to cross-check with the information in the EMR.

• Review each sample within the EMR. This builds confidence while going through the EMR. If there are any surprises that you might unaware of, you'll know those surprises ahead of audit time.

• Print a copy of your policies and procedures to have for reference.

• Print a copy of the sample claims (with MRNs) to easily review with the auditor. If you don't have MRN numbers easily accessible from your TPA, write in the MRN number manually and include any significant notes.

UPDATED AREAS OF 2023 DATA REQUEST

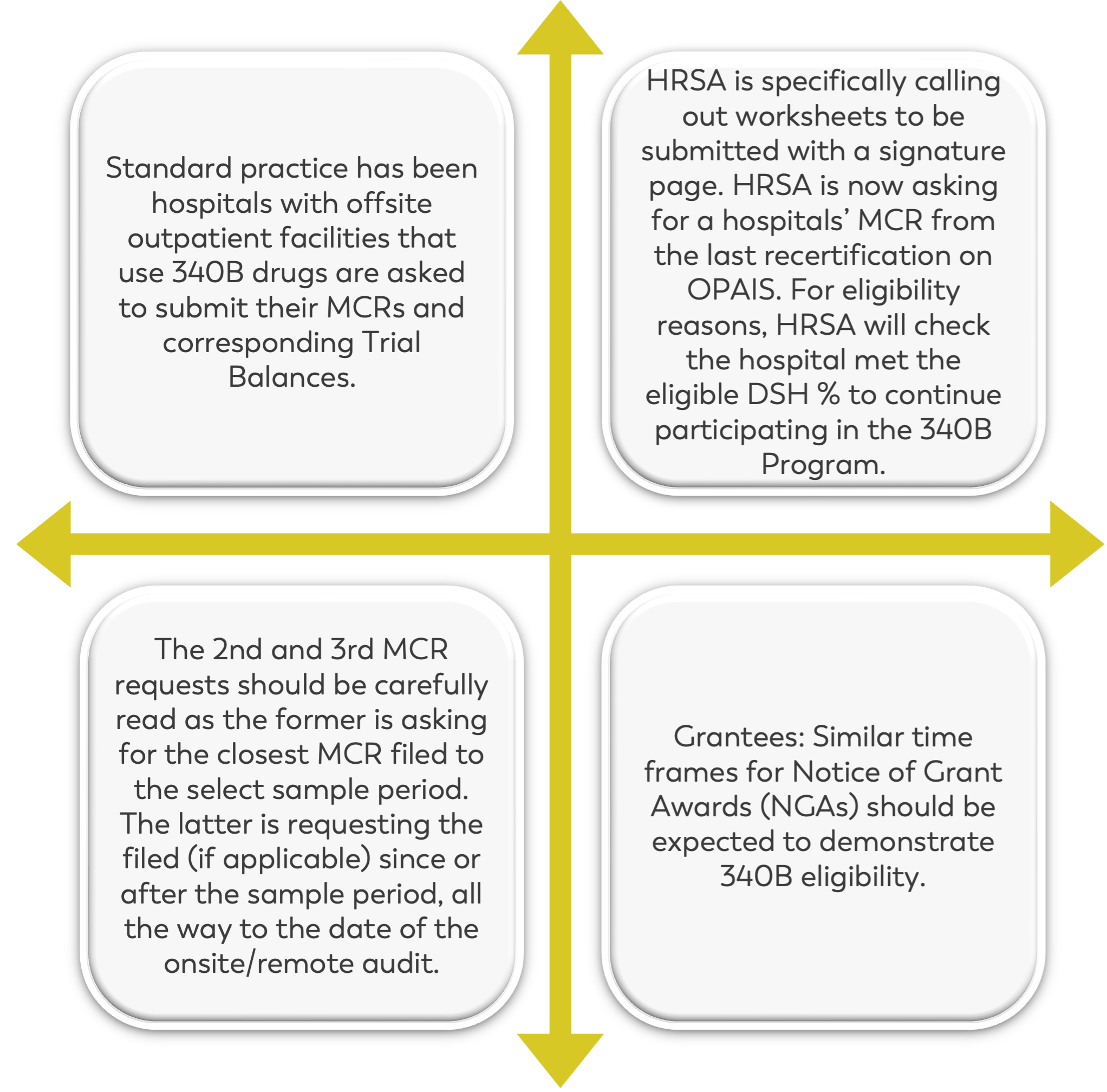

Policies and Procedures

In 2022, the Data Request stated you must document and account for wastage of a drug not administered. HRSA clarified this language for those Covered Entities that do not physically administer drugs from one of their clinics/child sites but may accumulate by charge on dispensation.

It’s important to include this updated verbiage in your policies and procedures and have documentation to account for not only administration, but also dispensation.

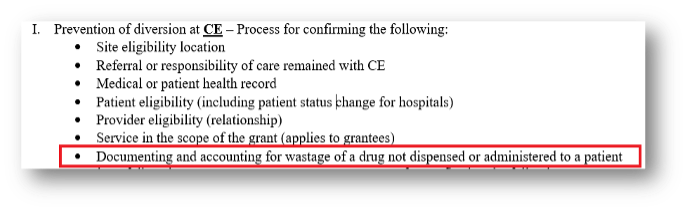

Section 2: CE Eligibility Documentation

There have been several changes made to Section 2 from 2022 to 2023. Previously, hospitals with outpatient visit facilities were required to submit their Medicare Cost Report and corresponding trial balances for the sample period only, up until the date of the audit.

However, this has been amended so that you must look at how your fiscal year will end to determine if you’re required to submit more than one Medicare Cost Report.

HRSA is also requesting the encrypted signature stamp on Worksheet S. Keep in mind that submitting more than one Cost Report, will require you to pay close attention to your DSH percentage – noting any changes that could potentially cause ineligibility.

Additionally, it’s now required to submit not only your trial balance, but also a full Cost Report or full crosswalk that outlines:

• The 340B ID

• Name, as identified on OPAIS

• Address

• MCR line number and cost center description as listed on MCR Worksheets A & C

• Trial balance name and department code/account

• Location code or shorthand used to identify the site in the electronic health record (HER)

• Indicate whether or not 340B drugs are utilized during encounters at each site

Lastly, if a hospital is owned or operated by a State or local government, you must provide documentation that indicates the hospital is owned or operated by a State of local government. Examples of documentation to demonstrate the hospital is owned or operated by a State or local government may include:

• Law that created the hospital

• Documentation from the State or local government demonstrating ownership

• Hospital charger

• Bylaws

• Documentation from the IRS describing the hospital

Note that more than one document may be necessary to demonstrate eligibility. Any documentation provided should clearly state the hospital’s ownership, the date ownership was established, and the name of the hospital.

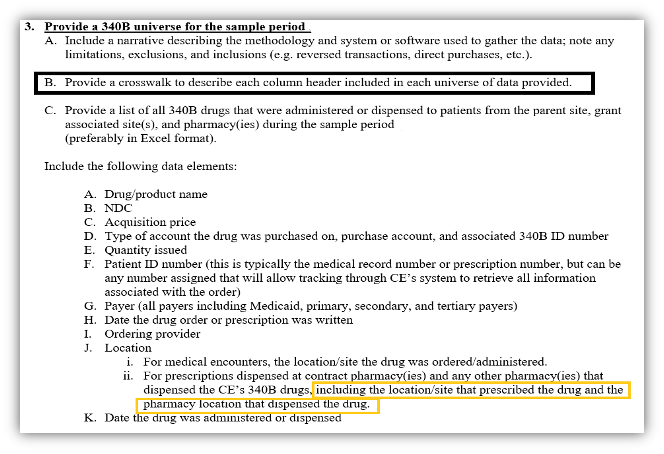

Section 3: 340B Universe

Section three has recently been broken out into sections A-K to make it easier to understand. The main updates include:

1. HRSA minimized DRL-3 A and separated the last sentence into its own subsection.

2. Section DRL-3 C is requesting the origination of the contract pharmacy prescription with the Covered Entity alongside the pharmacy location of the dispensed drug.

Section 5: Purchasing Information

There have been quite a few significant changes from 2022 to 2023 to necessary purchasing documentation:

- Section A: Now requires a crosswalk or detailed list cross referencing each wholesaler, account number, account type and location. For example, if you are a DSH facility and have GPO, WAC and 340B, you need to include all this information along with the wholesaler, account type and purchasing location(s).

- Section B: For accounts that did not have any purchases during the sample period, HRSA is requesting the most recent invoice (outside of the sample period).

- Section C: HRSA has underlined ‘all pharmacy(ices)’ to ensure CEs submit data for each pharmacy – including contract pharmacy, specialty, infusion, mail order, etc. Note that HRSA is also only wanting the CE to provide the pharmacy(ies) that had 340B purchases within the sample period.

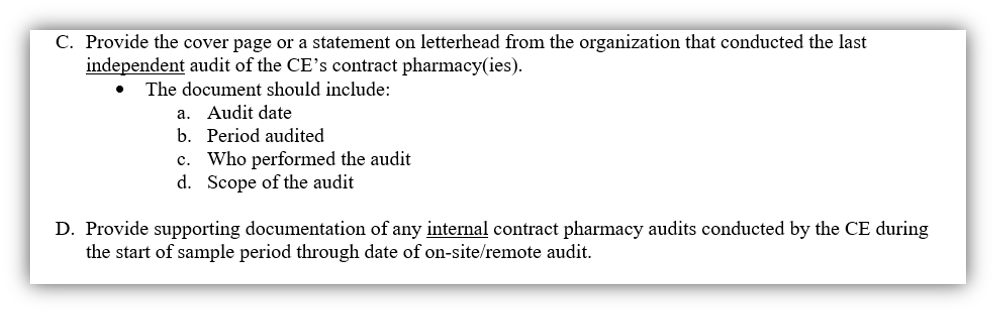

Section 6: Contract Pharmacy Documentation

HRSA is now asking for proof of internal audits during the DRL. They are also asking for proof that external audits are being done.

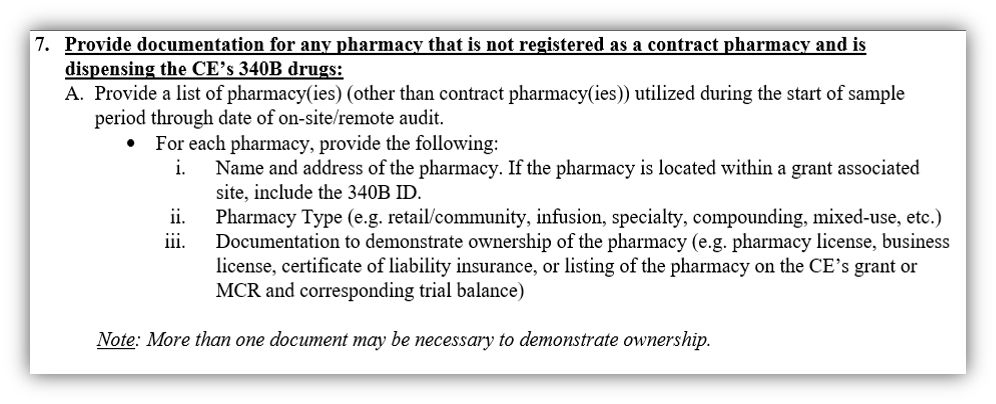

Section 7: Non-Contract Pharmacy Ownership

If you have an in-house pharmacy, infusion pharmacy, any pharmacies that are within your clinics or child sites, you need to be prepared to show proof of your ownership, even if you’re currently using a company to assist in managing that in-house pharmacy(ies). This is a brand new requirement.

Section 9: Medicaid Billing

This has changed slightly from last year. Now, if a Medicaid bill for a site is not available during the sample period, HRSA is requesting a recent bill (outside of the sample period).

We know how stressful an impending audit can be. That’s why it’s important to be proactive and ensure preparedness by performing mock HRSA audits, maintaining all proper documentation and staying up to date with the latest changes to the 2023 Data Request List.

McKaylin Felton, Account Management

ACI

Follow Cervey on socials to stay tuned for upcoming webinar announcements:

Contact Cervey for a demo of our 340B suite of web-based products that help 340B-eligible healthcare providers with their of their most pressing 340B needs: maximizing savings, ensuring compliance, and optimizing the performance of their contract pharmacies.